The pound crashed, what’s next?

November 2, 2022

Welcome to Chasing Alpha, your comprehensive destination for everything finance. The macroeconomic environment has been brutal. On Sept. 26 2022, the British pound fell to a record low due to the market’s expectation that the government will continue to borrow money. Simultaneously, this was also a day when bitcoin was up in value. Bitcoin’s price is based on an incomprehensible amount of factors, such as people exchanging pounds for bitcoin. What do the poor fiscal decisions and lack of accountability say about fiat currencies?

To address how fiat currency is affected, one must first understand what a fiat currency is. A fiat currency is any currency that is not backed by another asset. The large majority of government issued currencies, such as the U.S. dollar and British pound, are fiat. The two aspects that give fiat value is the government stating currency is a legal tender and the people believing the government.

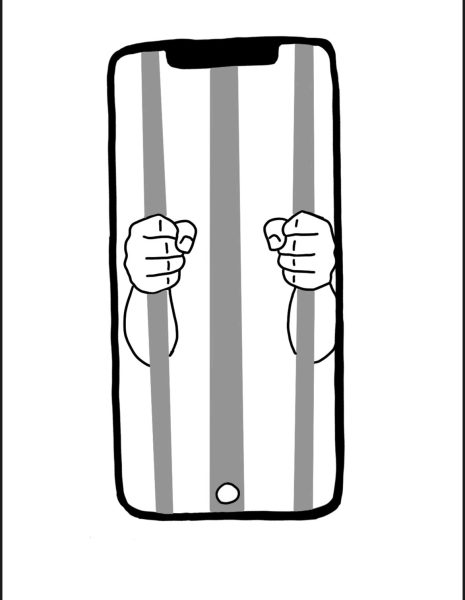

When investing, an alternative to fiat currency is cryptocurrency. A cryptocurrency is a digital currency where transactions are recorded and validated on a blockchain — a decentralized network of computers which communicate with one another to validate and keep track of transactions. The most famous example of cryptocurrency is Bitcoin. Unlike fiat currency, Bitcoin is transparent with how new Bitcoin will enter the market. This factor makes bitcoin a hedge against government issued fiat currency. According to Merriam Webster’s dictionary, a hedge can be defined as “do[ing] things that will prevent great loss or failure if future events do not happen as one plans or hopes.” Therefore, owning cryptocurrency is a hedge against fiat because it is backed by something: the crypto network. If fiat currency fails, one still has some of their wealth because they hedged.

Fiat currencies are inherently flawed because they give the means of distribution, supply and value to a small number of people. Take the dollar for example. At any point, a select group of government leaders can press a button and print billions of dollars, effectively devaluing each dollar in circulation. Recently, the U.S. has been printing trillions of dollars, and, according to Techstartups.com, “Since January 2020, the U.S. has printed nearly 80 percent of all U.S. dollars in existence.” The effects of printing dollars at such an extreme rate is reflected in the inflation rate, which is currently at a 40 year high of 8.26 percent. In other words, every dollar is worth 8.26 percent less than the year before. It is important to note that inflation is caused by a variety of factors besides printing money; though, printing money is one of the largest contributors. Governments are the only entities who can print more fiat currency, meaning a small percentage of the country can change all elements of a fiat currency.

Moreover, the pound fell due to decisions similar to those made by the U.S. government. Not taking action and hedging against fiat currency is like seeing a friend get burned by a hot plate and then touching that plate. It makes no sense to be the victim of history repeating itself.

An idea that will make its way into the history books if well executed is Modern Monetary Theory (MMT). MMT is the idea that the government can print and spend money with no consequences. The large majority of economists believe that MMT is a destructive idea which could lead to the collapse of the economy. Regardless, politicians continue to promote policies that are based on MMT, such as printing 80 percent of all dollars in existence. Bitcoin could not have a “printing” problem because a predetermined algorithm decides how bitcoin is distributed into the market.

Buying cryptocurrencies in the long run will transfer wealth away from fiat. Cryptocurrencies enable people to know how a currency will operate before making it their medium for exchanging goods and services and storing value. The Bitcoin Whitepaper tells every user exactly how bitcoin works. Furthermore, there will never be more than 21 million Bitcoin — which is implemented into the Bitcoin code and will never change. The U.S. dollar has neither of these factors in place.

The pound crashing is a result of a bad government policy. It is illogical to believe that other governments won’t follow in the United Kingdom’s footsteps, especially with the rise of MMT. Cryptocurrency is a hedge against fiat because it has a tendency to be transparent and decentralized. What will you do? Will you watch your money become less valuable by the day or will you make the switch to cryptocurrency?