New student debt relief plan offers more opportunities

Taking to the streets, protesters advocate for debt cancellation in support of loan relief.

September 30, 2022

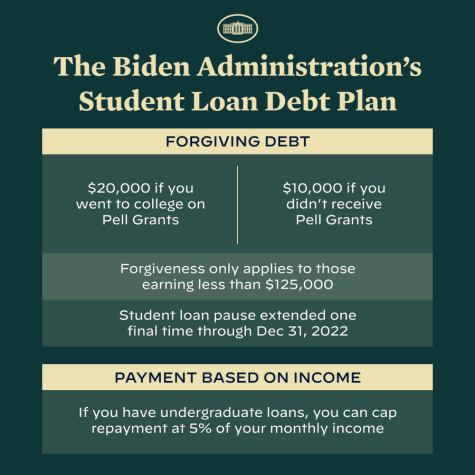

On Aug. 24, 2022, President Joseph Biden announced a three-part plan offering support to those with student debt. The plan will provide targeted debt relief as a collective effort to address the burden of college costs, along with re-working the student loan system so it’s manageable for low income families.

Over the past 50 years, the cost of a four-year university has nearly tripled, even when accounting for inflation. Previously, student loan relief was provided through Pell Grants, government subsidies that give grants to students with financial needs to help pay for college. However, these grants are limited and, over the past few years, have only covered one-third of the cost of four-year universities, compared to the 80 percent they once covered.

With the new relief proposal, the Department of Education will provide up to $20,000 in debt cancellation to recipients with loans held by the Department of Education, and up to $10,000 in debt cancellation to recipients who did not receive a Pell Grant. Those eligible for this relief must either be an individual with an income less than $125,000 per year, or a married couple with an overall income of less than $250,000, making the plan targeted toward the middle class.

Some economists wonder whether the plan will lead to an increase in inflation. In California, the minimum wage is about $15 due to a high cost of living. Advanced Placement economics teacher Ann Tepovich explains the possible problems this upcoming relief program may cause.

“One school of thought [is that] if I owe $10,000 in loans and I don’t have to pay that back, then that gives me $10,000 to go spend in the economy,” said Tepovich. “Right now, with prices rising, if a lot of people have a lot of money to go out and spend, then that’s going to pull up prices even more.”

However, the Biden Foundation believes debt relief is more necessary than ever. The current cumulative federal student loan debt is around $1.6 trillion U.S. dollars. These debts have placed a significant burden on America’s middle class. The Biden administration claims in their announcement of the loan relief that, “high monthly payments and ballooning balances make it harder for [middle class individuals] to build wealth, like buying homes, putting away money for retirement and starting small businesses.”

According to an analysis done by the Department of Education, nearly one-third of student borrowers have thousands in debt, with no degree to show. This may be a result of the costs of classes being too high, and many students having to discontinue their studies due to the financial burden. Additionally, student debt disproportionately affects certain communities, falling substantially more on Black borrowers.

“Twenty years after first enrolling in school, the typical Black borrower who started college in the 1995-96 school year still owed 95 percent of their original student debt,” said the Biden administration in their White House Website. “Twenty years after first enrolling in school, the typical Black borrower who started college in the 1995-96 school year still owed 95 percent of their original student debt. — The Biden Administration.

Many economists indicate that this program is temporary and lacks permanent measures to ensure the debt crisis doesn’t surge again. In response, the Biden administration has ensured their program includes preventative and cautionary measures, by making a promise to keep the student loan system as a more manageable system for current and future borrowers.

Long time borrower and economics teacher Stephen Hart graduated from the University of Michigan first in 2012, and then in 2013 for his masters, both times taking out student loans. The Biden relief program may be applicable to Hart, but, due to the immense debt he still carries, the benefits don’t cover all of his debts. However, Hart believes this plan can be inherently beneficial to borrowers and the United State’s economy as a whole.

“I think this [the relief program] is fantastic and is a great decision in many facets,” Hart said. “Debt is really restricting in so many ways. If we want to grow our economy and have access to the American dream, it requires lessening something that has become a real burden [to many citizens].”

This lessening of an immense burden is one notable aspect of Biden’s plan, but Hart believes the publicity surrounding the new relief plan will spark conversation regarding other options. Hart also stressed the importance of finding the best and most suitable plans for oneself.

As an educator, Hart heard of a loan relief program for teachers entitled the Public Student Loan Forgiveness (PSLF). PSLF is available to those working for a government agency. While in the plan, each year one makes 10 years of income-based payments and the rest of your loans will be forgiven after the tenth year. Hart has used PSLF for the past ten years, and this will be his final year before he will gain full relief from his loans.

“A lot of people aren’t even aware of other programs. They were shocked to find out that they’ve been paying [off loans] for this long and they probably could have had the rest of their [loans] forgiven a while back,” Hart said.

Overall, the plan has sparked a bit of a discussion, which Hart believes can help with the debt crisis.

“This new [program] has been widely publicized, and created a ripple in the news and in discussions,” Hart said. “[Now], more people will be aware that they get to qualify for [a variety of plans] and their loans will be forgiven, which is great.”