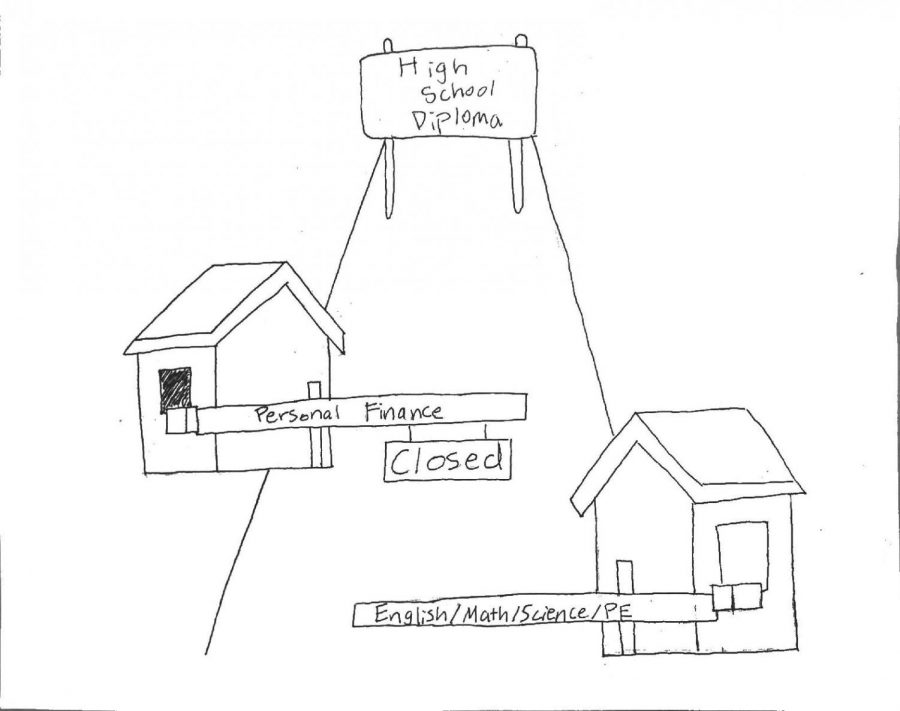

Required English classes build communication skills for participating in society. Required science classes ensure that students have a basic understanding of their natural surroundings. Required finance classes would help students invest their money wisely to plan for their future. So why does Redwood not have personal finance as a graduation requirement?

Currently, Redwood requires one semester of economics, with the option to enroll in a two-semester Advanced Placement curriculum. There is, however, no requirement to take a personal finance class before graduating from any of the five schools in the Tamalpais Union High School District (TUHSD).

The first semester AP Economics curriculum encompasses a macro lens that delves into the function of national and international economies. The course during the second semester focuses on the micro: interactions between firms and consumers. For the regular Economics class, all of these topics are combined into one semester.

The problem is that an economics curriculum simply doesn’t cover the spectrum of skills that all high school graduates should have regarding their capital.

A personal finance curriculum includes learning how to manage personal cash flow, strategize credit use and monitor financial security. They are all connected to handling monetary-related decisions. Including personal finance as a requirement would ensure that all students who graduate would have a general idea of how to invest their money wisely. By doing so, they are maximizing their resources and therefore setting themselves up for financial prosperity in the future. Additionally, taking a required personal finance class at Redwood might be a student’s only opportunity to receive a free education in financial literacy.

According to the Council of Economic Education, there are only 17 states that require students to take a personal finance class before graduating, but the American Economic Review reported that “a 0.2 increase in standard deviation on a financial literacy score would result in a predicted additional $13,800 in new wealth.” By having all students take a semester or year-long course in personal finance, high schools would present students with the platform to make more informed decisions regarding their money in the future.

While Redwood offers a class where students learn how to cook, file taxes and pick a college roommate, it isn’t sufficient in preparing a young adult to handle their money wisely. Independent Living, as the name suggests, teaches students basic responsibilities for adulthood, but it is too broad and does not get into necessary detailed monetary management for students. Being able to file taxes is a necessity, but a class specializing in financial literacy would push students to take the money they have and learn to grow it; these skills are what truly establish independence.

Emphasizing financial literacy becomes more important in a time period where credit card debt is an impending problem for an increasing amount of people. In fact, almost 50 percent of Americans who use credit cards are carrying debt, according to a survey by Clever Real Estate. The same survey revealed that “millennials are more financially responsible than older Americans, [but] they are also less knowledgeable about interest rates.” By infusing high school students’ education with instruction on interest rates and loan management, they will be adequately prepared to avoid accumulating credit debt.

According to Forbes Business Magazine, American citizens are consuming double the amount of material goods in comparison to 50 years ago. With 70.2 percent of American households owning at least one credit card, according to the U.S. Census Bureau, the general trend in history has shown a shift toward their overuse. As younger generations are introduced to the powers of credit and borrowing, it is only sensible that their education matches this shift. In taking a personal finance class during high school, students can learn to adapt to unexpected expenses, consumer culture and significant purchases, so that their debt won’t accumulate to ridiculous amounts. Requiring a personal finance class in high school won’t miraculously disintegrate credit debt and student loans across the country, but it starts with change…and not the type found in pockets.