The cold, hard truth of a cold, hard cashless economy

June 6, 2019

While on a recent college trip in Southern California, I walked into a restaurant to buy lunch when I noticed a sign notifying the public of their cashless system. Looking at my wallet filled with bills, I realized that their restaurant had lost a customer. Although cash is becoming a less popular manner of paying for items, it is not completely obsolete. In order to provide for the customer (me, in need of a sandwich), increase profits and remain inclusive, businesses should continue to include a combination of cash and card payments.

The term cashless means that a business will only accept credit or debit cards and will reject physical cash or coin. Some countries have chosen to adapt to the cashless movement, transitioning almost entirely to credit. In 2018, only 13 percent of Swedish citizens reported using cash for a recent purchase and half the population uses a payment app called Swish, according to NPR news. Nearly every aspect of Swedish life follows this trend: their banks have removed ATMs and even buses do not accept paper money. While the decrease in cash handling and counting has saved some businesses valuable time and eliminated the likelihood of a robbery, corporations may be the sole ones benefiting from only accepting cards. Seven out of 10 people reported to Sifo, a Swedish polling firm, that they prefer having a cash payment option available for purchases. Why would businesses decide to go cashless if that does not correspond to what its customers want? Although Sweden and the U.S. have many differences, Sweden’s actions in the cashless movement can provide a model to show what our society should avoid based on our own values—emphasizing what the customer wants, not just what is more convenient for the business.

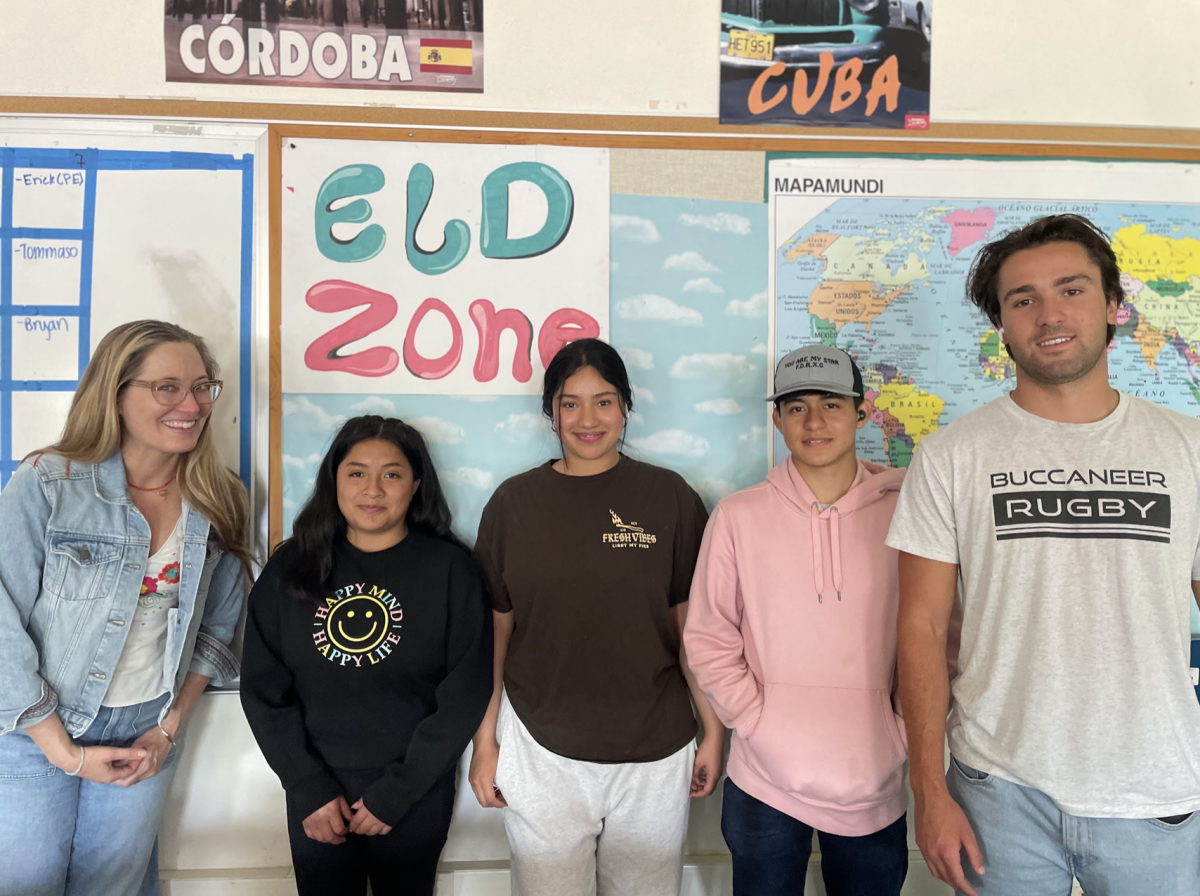

Additionally, certain requirements to actually get a credit card may stop people from being able to obtain one, which unfairly works against groups of customers. According to Card Rates, applicants must be 21 and older or 18 with an adult cosigner, have a verifiable source of income and provide an address and social security number to acquire a credit card. These prerequisites already provide complications for young adults, unemployed or homeless people and non-U.S. citizens. Additionally, CNN Money stated that 10 million households were living without a bank account in 2012, and a 2017 survey by Economic Inclusion found that 7.4 percent of households in California were unbanked, meaning that they don’t use any type of banking institution. These people would not be able to obtain a practical “online” form of money, and therefore would not be able to participate in an economy that doesn’t accept any form of physical payment. The idea of a cashless economy completely disregards the people who don’t use credit for whatever reason.

As an incoming college student who will need time to develop credit, and as someone who just likes having cash available, I know I am personally against the cashless movement. In order for them to remain fair and keep their customers, businesses must take others’ financial struggles into account. Let’s get this bread.