As college admission letters arrive in the mail, many students’ heart-thumping anticipation and euphoria are soon overshadowed by another key component to the admissions process: the cost of attendance.

For students planning to attend a public university in another state, these costs seem to be unfairly inflated. Before writing that hefty tuition check, students attending public universities in another state can opt to achieve in-state residency to pay the in-state tuition if they are fully committed to saving money.

Total tuition and fees at an out-of-state public university often presents a greater burden than costs at private schools, as public universities tend to keep a closer eye on their funds.

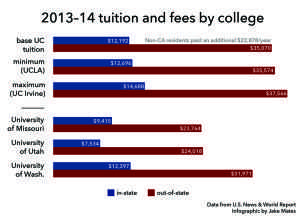

More so, tuition for in-state students and out-of-state students can have steep differences in price. According to a College Board study, the average total tuition and fees for in-state students at public four-year institutions was $8,893 in 2013-14, whereas out-of-state tuition was $22,203 in 2013-14.

In a similar study by the U.S. Department of Education in 2011, found that tuition, room and board costs at public institutions have risen 42 percent since 2000, after adjustments for inflation.

College & Career Specialist Paula Vantrease said that in order to pay in-state tuition, students must fulfill all state residency requirements, often times well before the beginning of the school year. This can be very difficult, as public universities have specific rules to protect their money.

“From what I have learned over the years, to establish residency in a state means that you have to prove that you are going to be living in that state for reasons other than going to that school,” Vantrease said. “That means giving up your California driver’s license, and getting a driver’s license in that state. It means registering to vote in that state.”

Vantrease also warned that most four-year universities are very strict about achieving residency, which often times requires a full-on commitment on the student and his or her family.

“I don’t think it is as easy as what some students think it is [to establish residency],” Vantrease said. “You don’t just go move there. You actually go and live there, work there, don’t come home in the summer. You stay there in order to show that you are doing more than just going to the school.”

Redwood class of 2011 graduate Lauren Haden put in the effort to establish residency last year while attending the University of Missouri. Haden paid out-of-state tuition her freshman year, but as a sophomore, she said a friend in her sorority told her about the college’s residency requirements, and encouraged her to get her tuition lowered.

Missouri required that she work in the state to earn a minimum of $2,000 within a year’s period, work consistently, and stay in Columbia all year aside from spring or Thanksgiving break.

“You can’t leave during the summer,” Haden said. “You can take up to ten days off, but you have to print out every single record of your banking account, every single Starbucks or bookstore transaction, and give it to a residency officer.”

Haden said she did not take days off for Thanksgiving break in order to work at her part-time job at Victoria’s Secret. She said it is hard to work on top of school, and be involved in social activities.

“It is a big balance to manage your time, but it gave me a lot of responsibility, knowing that this is something that I was doing for my whole family, not just because I wanted to be from Missouri.” Haden said.

Excluding scholarship money, Haden saved $3,742 in tuition, as in-state tuition is $10,286, and out-of-state tuition is $14,026. While this may seem like a small difference in price, other schools like the University of Michigan-Ann Arbor charged an in-state tuition of $13,819, and an out-of-state tuition of $40,496 for their 2013-14 academic year.

For students as committed as Haden, paying less tuition can save their family money in the long run. As of 2011, outstanding student loan debt represented 5 percent of all outstanding debt in a household, over double its percentage in 2001, according to a Pew Research study. In the same study, 48 percent of student borrowers felt that their student loans made it harder to pay bills and to “make ends meet” after graduation.

While Haden achieved state residency on her own, the Colorado-based company In-State Angels, said it is available to take students through the long, often messy process by creating a personalized plan of action. The business only bill clients after they have achieved residency, in which they charge a fraction of the savings earned by gaining residency.

Manager Jake Wells said they understand difficulties and nuances involved in the process. He also said that falsehoods in an application could result in criminal charges and university disciplinary actions like expulsion.

Basic residency requirements involve proving that a student is in the United States legally (whether they are citizens, have permanent resident cards, or a qualifying visa), and can prove that they are lawfully residents of said state for purposes other than education. Wells said the time period of this residency varies.

For example, the University of Washington in Seattle asks students to live in the state for one year for purposes other than education prior to their enrollment at the university. If a student chooses to enroll immediately, their time as a student won’t be counted towards the establishment of in-state residency.

Senior Ian Brodie is currently attempting to achieve in-state residency for the University of Washington by proving that he is moving to Washington for reasons other than to attend the school. Having lived there for 13 years, he still has a phone number with a Washington area code, and his whole family plans on moving back to the state.

“My mom had a job there that she’s been offered again while we have been in California,” Brodie said. “Officially, we’d be moving there for my mom’s work.”

While Wells said he would need more information to confirm the possibility of Brodie gaining in-state residency, he noted that most of his clients will rarely get in-state tuition their freshman year, unless they came to the company for help well before the student’s senior year of high school.

Nevertheless, there are a few other ways to work around such requirements. Behind their confusing residency jargon, University of Washington will hypothetically grant non-residents in-state tuition if they pursue a part-time education their freshman year (taking less than six credits per quarter), and can prove other reasons for moving to the state.

Other less common ways to pay in-state residency are getting married to someone in that state, moving the whole family to the state well before the application process, and joining the military, as members of which can “pick a state” to enroll in a school.

If the above aren’t foreseeable to a student, many states are more lenient with their requirements, allowing, and even encouraging, out-of-state students to claim residency after their freshman year. Class of 2013 alum Arelys Desouza said her school, the University of Utah, gives out-of-state students the opportunity to claim residency by the end of their freshman year.

Desouza said she wanted to gain residency after the university discussed the opportunity and the requirements during freshman orientation. A checklist of proof of residency included changing her phone number, getting a new driver’s license and car insurance, and registering for voting.

Claiming in-state residency may also have consequences and limitations for the rest of a student’s college career. Part-time students at the University of Washington for example, would not be eligible for student housing in dorms, and would likely take longer to graduate. Students still in the process of claiming residency might have to stay in the state all year long, and have a limited opportunity to travel out of the state.

“They give you a certain amount of days to visit family,” Desouza said. “I went back to California, but they definitely want you to stay here, because if you’re claiming residency, then you are expected to live here.”

Ultimately, Vantrease stressed the importance of asking the university questions to find out more information, often times carefully reading the requirements, and their caveats and quirks, to lets students view what kind of commitment they must have to get lower tuition. A common snag in a student’s residency application is from which state are they paying taxes, which generally indicate permanent residence.

“Students who have parents that still live in California claim students as “dependents” in their taxes,” Vantrease said. “As long as your parents claim you as dependent, and you are under the age of 24, your parents are responsible for your education. So when you provide parental information in your FAFSA (Free Application for Federal Student Aid) it will show that your state is California.”

Lauren Haden made sure her parents claimed her as “independent” in order to get in-state tuition at the University of Missouri.

“I have to file my own taxes, but they can still pay my tuition,” Haden said.

While paying in-state tuition can be a boon to those from out-of-state, controversy arises over its benefits to those who have maintained legal residence most of their lives.

“In the UC system, our kids with 4.0 plus can’t get into different UCs because the schools want the out-of-state tuition,” Vantrease said. “Yes, they are supposed to limit that, but it still takes away from those of us who pay taxes, in the various states that we are talking about.”

If gaining residency in another state seems too challenging, a separate option for lower tuition is the Western Undergraduate Exchange Program (WUE, pronounced “woo “whee”). The WUE lets eligible students pay 1.5 times the in-state tuition rate of select public universities from certain western states. Examples of schools with the WUE program include University of Arizona, University of Hawaii at Manoa, and Portland State.

“If the tuition to go to Western Oregon is $10,000 a year for a student, a non-resident would be about $22,00.” Vantrease said. “If you got the WUE, it would be $15,000. But this is only for specific schools, and each school has its own criteria.”

Vantrease said that criteria for the WUE program often include minimum GPA and test scores. Students may also be limited in majors.